What If the European Union Collapses?

Analyzing the Triggers, Scenarios, and Global Impacts of an EU Disintegration

For decades, the European Union has stood as a symbol of unity triumphing over division. Credited with fostering peace, driving economic growth, and cementing Europe’s position as a global leader, its foundations are now facing unprecedented challenges.

The EU’s survival is being tested on multiple fronts:

Economic inequalities between member states.

Nationalist movements gaining traction.

Geopolitical pressures from powers like Russia and China.

Brexit has shown the world that leaving the Union is possible, leaving many to question whether it was just the beginning.

In this analysis, we’ll uncover:

What could trigger the EU’s collapse.

The scenarios under which it might unfold.

The far-reaching consequences for Europe and the world.

By examining historical data, economic trends, and political movements, we’ll explore whether the EU’s resilience can withstand these challenges or if we are witnessing the prelude to its disintegration.

Triggers for the Collapse of the European Union

1. Economic Disparities Within Member States

The European Union’s unity has always hinged on balancing the diverse economic realities of its member states. However, stark disparities threaten this foundation.

Northern Europe: Countries like Germany, the Netherlands, and Luxembourg showcase high GDP per capita, low unemployment rates, and robust fiscal health.

Southern Europe: Nations such as Greece, Italy, and Spain struggle with high public debt, unemployment, and slower economic growth.

These imbalances are not purely financial—they create underlying tensions.

North-South Divide: Southern nations criticize austerity measures imposed by the North, while Northern countries voice concerns over the South's fiscal responsibility.

GDP Per Capita by Country: Highlights economic strength disparities.

Government Debt (% of GDP): Shows how debt levels vary dramatically between nations.

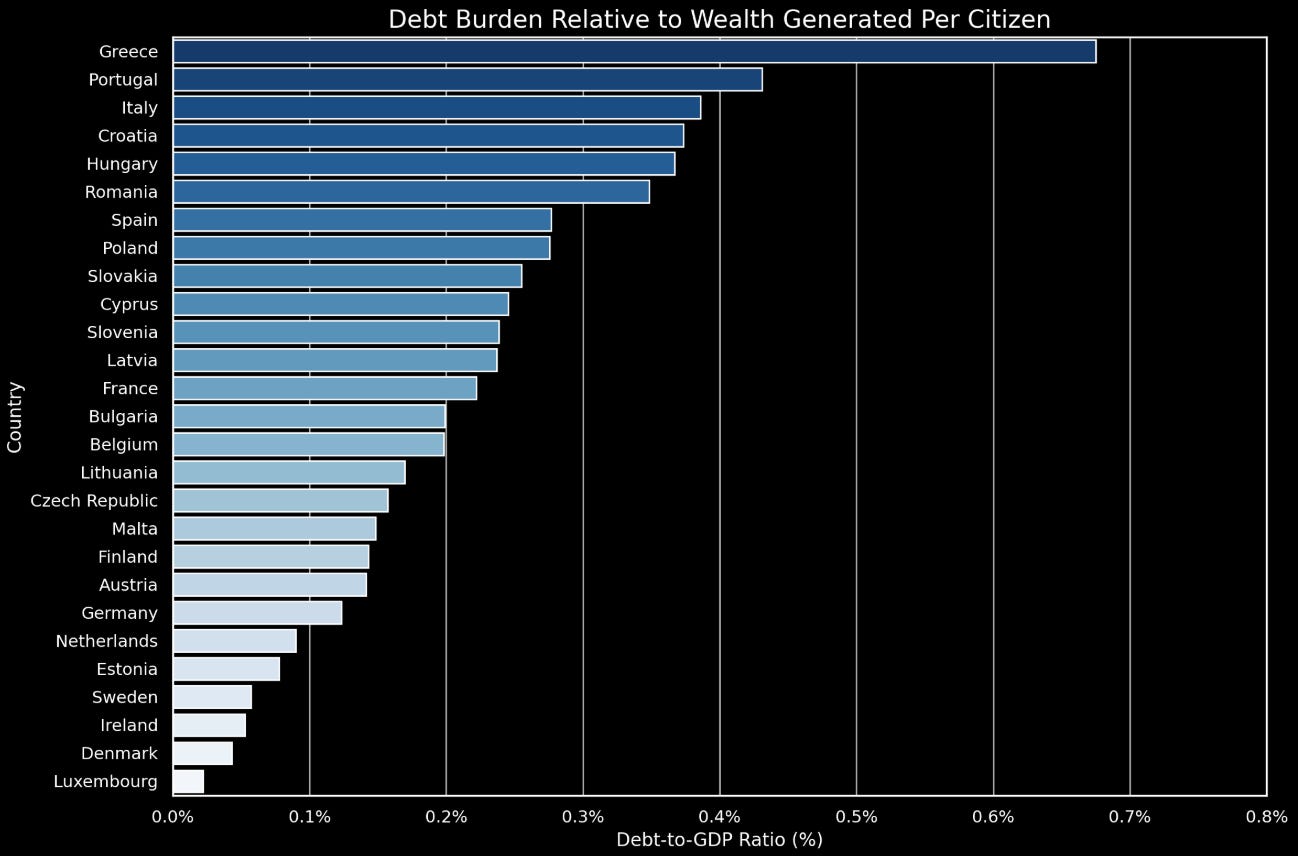

Debt Burden Relative to Wealth Generated Per Citizen

This chart illustrates the debt-to-GDP ratio as a percentage, showing how much government debt exists relative to the wealth generated per citizen. For example, a value of 5% means that for every $100 of wealth produced by an individual, the government owes $5 in debt. This visualization helps compare the financial burden across countries in an easy-to-understand way.

Government debt is more than just an economic figure—it has real-life implications for citizens.

The debt-to-GDP ratio provides insights into a country’s fiscal health and its impact on people’s everyday lives.

1. Higher Ratios Mean Higher Debt Levels

Countries with high debt-to-GDP ratios often experience:

Higher Taxes: Governments may increase taxes on income, goods, or property to repay debts, leaving citizens with less disposable income.

Reduced Public Services: Funding for healthcare, education, and infrastructure may be scaled back, affecting the quality of life for everyone.

These dynamics mirror broader challenges discussed in Decades of Change: Unauthorized Immigration in the U.S. (1990–2023), where economic strain intersects with social policy.

2. Reduced Investment in the Economy

Excessive government borrowing crowds out private investment:

Fewer Jobs: Businesses scale back hiring due to limited investment capital.

Stagnant Wages: Growth opportunities diminish, impacting citizens’ purchasing power.

3. Vulnerability to Economic Crises

High debt-to-GDP ratios make countries less resilient to unexpected crises:

Underfunded Services: Healthcare, emergency response, and disaster relief may suffer.

Economic Instability: Austerity measures like tax hikes or spending cuts can disrupt the economy.

4. Inflation and Cost of Living

In extreme cases, governments may resort to printing money to cover debts, leading to:

Higher Inflation: Erodes purchasing power as goods and services become more expensive.

For parallels in policy shifts, see Unlocking The Economist’s 2025 Cover, which explores economic transformations.

5. Stability in Lower Ratios

On the flip side, countries with lower debt-to-GDP ratios enjoy:

Better Services: More funds for public infrastructure and welfare programs.

Economic Growth: Lower borrowing costs foster long-term stability.

The Bottom Line

A country’s debt-to-GDP ratio isn’t just a metric—it shapes taxes, jobs, and public services.

High Ratios: Lead to financial burdens and instability.

Low Ratios: Foster fiscal health and growth.

Understanding this relationship empowers citizens to advocate for policies promoting sustainable government spending and economic resilience.

What the Chart Shows

High Debt-to-GDP Ratio (Red): This represents increased financial burdens and instability, with a 70% impact level.

Low Debt-to-GDP Ratio (Green): Indicates greater fiscal health and growth prospects, with a 30% impact level.

Historical and Current Context

The European Union has been a beacon of economic and political integration, transforming the continent through shared goals and cooperation. However, its history reveals both triumphs and challenges that shape its present.

Economic Integration: A Success Story

Since its inception, the EU has fostered unprecedented economic collaboration among member states. By eliminating trade barriers and adopting the Euro, the EU has made intra-European trade the backbone of its economy.

Key Insight:

In 2022, 70% of EU trade occurred within its borders, demonstrating its deeply interconnected economic structure.

Nations like Germany and France consistently lead in GDP contributions, bolstering the EU’s overall economic strength.

Trade Dependency and Public Sentiment

Trade dependency underscores the EU’s strength but also its vulnerability. Countries like Poland and Hungary heavily rely on EU funding and market access, making any disruption potentially catastrophic.

Key Insight:

Public sentiment dipped during the 2012 Eurozone crisis but rebounded after the 2016 Brexit referendum, reflecting citizens' recognition of the EU’s stabilizing role.

Chart Insights:

Intra-EU Trade as a Percentage of GDP:

High Dependency Countries: Luxembourg (85%), Ireland (80%), and Slovakia (72%) heavily rely on EU trade.

Moderate Dependency Countries: Germany (45%) and France (42%) benefit from trade but maintain diversified global relationships.

Low Dependency Countries: Sweden (32%) and Greece (30%) rely less on intra-EU trade, focusing on domestic and non-EU markets.

Why Does This Matter?

High Dependency Countries: Vulnerable to disruptions within the EU, such as policy or trade agreement changes.

Low Dependency Countries: Better positioned to withstand disruptions but risk missing out on the benefits of deeper integration.

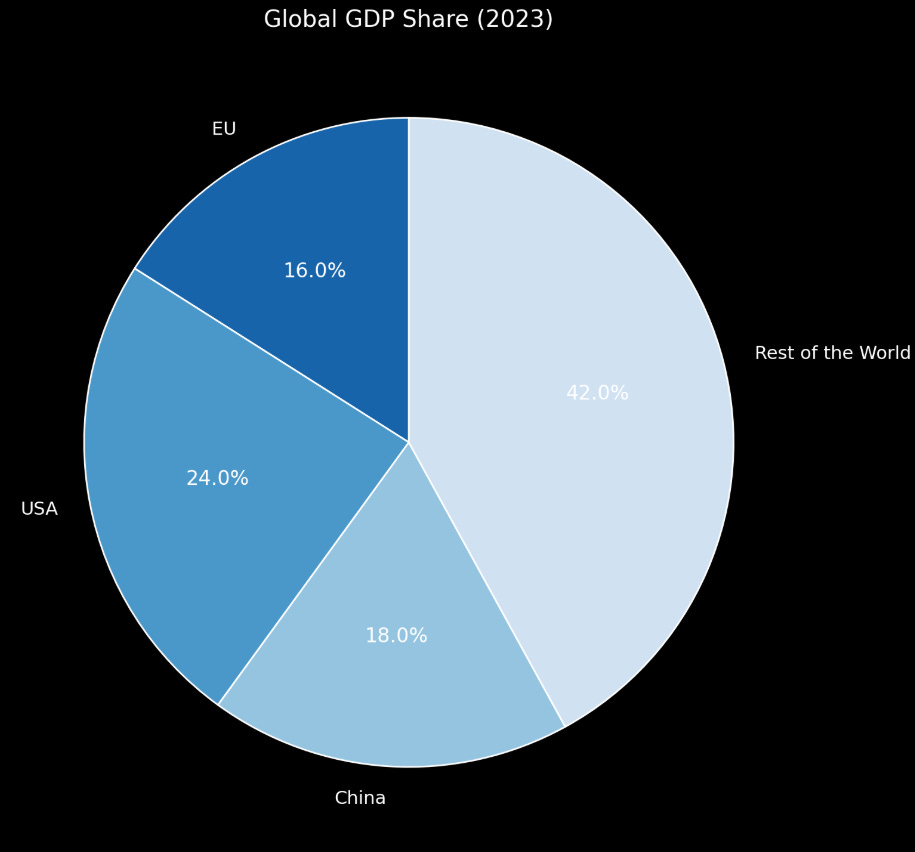

The EU in Numbers

GDP Share: The EU collectively accounts for approximately 16% of global GDP, marking it as an economic powerhouse.

Population: With over 447 million citizens, it forms one of the largest unified markets globally.

Trade Dependency: Intra-EU trade exceeds €3 trillion annually, highlighting the importance of its economic integration.

Summary

The EU’s historical success lies in its ability to unify diverse nations under a single economic and political framework. However, its interconnectedness makes it vulnerable to disruptions, whether from internal divisions or external pressures.

What a Collapse Might Look Like

Exploring Potential Scenarios

The collapse of the European Union could unfold in various ways, each with unique consequences. Here are the primary scenarios often considered by experts:

1. Complete Disintegration

In this scenario, the EU ceases to exist, with all member states reverting to independent governance and trade policies.

Key Impacts:

Borders Reinforced: Schengen Area dissolves, causing declines in mobility, tourism, and trade.

Economic Fragmentation: Over €3 trillion in intra-EU trade is disrupted by tariffs and logistical barriers.

Political Weakness: Without a unified bloc, individual states lose global bargaining power.

2. Partial Fragmentation

Some countries remain in a smaller, cohesive EU while others exit due to economic, political, or ideological differences.

Key Impacts:

Economic Realignment: Strong economies like Germany, France, and Netherlands dominate the new bloc.

Peripheral Isolation: Countries like Hungary and Poland could leave due to diverging priorities.

Geopolitical Tensions: Trade and migration disputes emerge between remaining EU and former members.

3. Functional Erosion

The EU survives in name but loses much of its effectiveness and influence.

Key Impacts:

Policy Paralysis: Decisions on critical issues like trade and climate stall.

Economic Decline: Fragmentation leads to reduced innovation and slower growth.

Rising Nationalism: Weak unity fuels nationalist movements within individual states.

Consequences of a Collapse

The collapse of the European Union would have profound effects across economic, political, and social domains. Each consequence highlights the deep integration of member states and the challenges they would face.

1. Economic Consequences

Trade Disruptions

The EU’s single market facilitates over €3 trillion in annual trade. A collapse would reintroduce tariffs, customs checks, and regulatory barriers, leading to:

Cost Efficiency Loss: Businesses face higher transport and compliance costs.

Global Competitiveness Decline: Exports lose their edge due to delays and increased costs.

Key Insight: Disruptions would hit sectors like automotive, agriculture, and technology, which depend on cross-border supply chains.

Euro Depreciation

The EU's collapse would destabilize global financial markets, causing:

Currency Volatility: Reverting to national currencies risks inflation and exchange rate instability.

Economic Uncertainty: Investors may withdraw capital, increasing borrowing costs.

Key Insight: A weakened Euro would have ripple effects globally, impacting trade partners and reserves.

Loss of EU Funding

Countries reliant on EU cohesion funds would struggle to replace resources, leading to:

Weakened Economies: Nations like Poland and Hungary face significant financial gaps.

Increased Inequalities: Widening wealth disparities create political instability.

Key Insight: Economically weaker nations would bear the brunt, escalating unrest.

2. Political Consequences

The collapse of the European Union would fundamentally alter the political landscape, both within Europe and globally. Here are the key political impacts:

Power Shifts

In the absence of the EU, larger nations like Germany and France are likely to dominate regional politics, while smaller countries may struggle to exert influence.

Key Impacts:

Fragmented Diplomacy: Without a unified EU voice, individual states must navigate global politics independently, weakening their bargaining power.

Reduced Collaboration: Shared initiatives on climate policy, defense, and technology would stall, impacting collective progress.

Weakened Alliances

The EU has been a pillar of transatlantic and global partnerships, such as NATO and international trade agreements. Its collapse would create:

Key Impacts:

Strained NATO Relations: Reduced EU cohesion could weaken NATO's ability to respond to security threats.

Trade Uncertainty: Negotiations with major economies like the U.S., China, and India would fragment, reducing Europe’s global influence.

3. Social Consequences

The collapse of the European Union would deeply affect the daily lives of its citizens, reshaping mobility, job markets, and cultural exchanges. Here's a breakdown of the key social impacts:

Loss of Mobility

The Schengen Agreement allows free movement across EU member states, enabling millions of citizens to travel, work, and live freely in other countries. A collapse would reinstate borders.

Key Impacts:

Restricted Travel: Border controls would lead to delays and increased travel costs.

Job Losses: Cross-border workers (e.g., those living in one country and working in another) would face significant challenges.

Tourism Decline: Reinstated visa requirements would deter travel within Europe.

Economic Inequalities

The EU has long worked to reduce disparities between its member states. A collapse would exacerbate these inequalities, particularly in Eastern and Southern Europe.

Key Impacts:

Rural Areas Affected: Regions reliant on EU agricultural subsidies and development funds would suffer.

Brain Drain: Skilled workers may leave struggling regions, worsening economic divides.

Cultural and Educational Setbacks

The EU fosters cultural exchange and education through programs like Erasmus+, which would likely end.

Key Impacts:

Fewer Opportunities: Students and researchers would lose access to international collaborations.

Cultural Fragmentation: Reduced funding for arts and cultural initiatives could weaken shared European identity.

4. Global Impacts

The collapse of the European Union would have profound ripple effects worldwide, disrupting trade, geopolitics, and global stability. Here’s a breakdown of the key global consequences:

Shift in Global Trade

The EU is a cornerstone of international trade, accounting for 16% of global GDP. Its collapse would result in:

Key Impacts:

Trade Disruptions: Major economies like the U.S., China, and India would lose a critical trading partner.

Market Realignment: Emerging economies, such as those in Asia and Africa, could strengthen their positions as global suppliers.

Currency Volatility: The Euro’s collapse would lead to instability in currency markets worldwide.

Chart Insights:

EU: Declining trade share from 20% to 7% by 2025.

US: Steady trade share, slightly increasing post-2015.

China: Significant growth, overtaking the EU and US by 2025.

Others: Remaining global trade distributed among smaller players.

Geopolitical Shifts

The EU has been a stabilizing force in global politics, promoting peace and cooperation. Its absence would lead to:

Key Impacts:

Power Vacuums: Nations like Germany and France may attempt to assert dominance, leading to regional conflicts.

Weakening Western Influence: Global power might shift further towards China and other emerging economies.

Decline in International Cooperation: Agreements on climate change, defense, and technology would falter.

What This Show:

Blue Regions: Areas where EU influence is critical (e.g., major EU member states and adjacent regions).

Red Regions: Countries that could experience geopolitical voids or challenges post-collapse (e.g., Ukraine, Moldova).

Impact on Global Stability

The EU’s collapse would undermine global trust in multilateral organizations like the United Nations and the World Trade Organization.

Key Impacts:

Weakened Institutions: Reduced European representation would weaken the ability of global institutions to enforce agreements.

Increased Uncertainty: Investors and nations alike would face greater economic and political instability.

Chart Insights:

Green Line: Global economic growth rate projections assuming the EU remains intact.

Red Line: Slower growth projections in a post-collapse scenario, reflecting fragmentation and instability.

5. Is Collapse Inevitable?

While the challenges faced by the EU are significant, its resilience has been tested and proven over decades. A collapse is not inevitable, and strong arguments and data suggest the EU may overcome its current struggles.

Counterarguments with Data

Past Resilience: The EU weathered major crises, such as:

2008 Financial Crisis: Coordinated recovery efforts to stabilize member economies.

Eurozone Debt Crisis: Bailout programs helped countries like Greece recover.

Brexit: The EU adapted to the loss of a major member while strengthening unity among remaining nations.

Rising Support for Reforms: Recent Eurobarometer surveys indicate:

70% of EU citizens support stronger integration to tackle shared challenges.

60% believe the EU is better equipped to handle global issues compared to individual nations.

What the Chart Will Show:

Blue Line: GDP growth rates showing recovery during key crises.

Vertical Lines: Major events:

2008 Financial Crisis.

2012 Eurozone Debt Crisis.

2016 Brexit.

2020 COVID-19 pandemic.

Economic Modeling

Cost of Disintegration: Studies estimate that disintegration could reduce the EU’s collective GDP by 10-15%, with significant losses for smaller nations.

Benefits of Unity:

Collective bargaining power in global trade negotiations.

Pooling resources for innovation, defense, and climate action.

Blue Line: Increasing support for EU reforms over time, peaking at 75% by 2025.

Red Line: Fluctuating but relatively lower support for EU dissolution, with a peak during major crises (e.g., the 2015 migration crisis).

Chart Insights:

Western Europe: Strongest support for reforms (75%) and minimal support for dissolution (10%).

Eastern Europe: Higher support for dissolution (25%) due to economic and political disparities.

Northern Europe: Generally aligned with reforms, reflecting stable economies.

Southern Europe: Divided, with significant support for reforms (65%) but also notable dissolution sentiment (20%).

6. Alternative Futures for Europe

While the collapse of the European Union would bring significant challenges, alternative pathways could redefine Europe’s future. These scenarios highlight potential ways to adapt and thrive.

1. Reforming the EU

Incremental reforms could address structural weaknesses while maintaining the core principles of the union.

Key Elements:

Flexible Integration: Allowing member states to opt in or out of specific policies, such as defense or immigration.

Economic Realignment: Strengthening fiscal policies to support economically weaker regions.

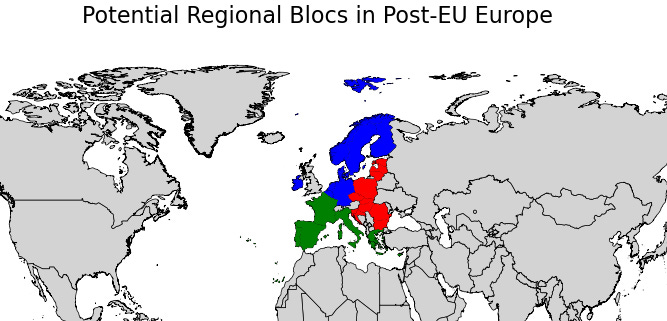

2. Regional Blocs

Europe could fragment into smaller, regionally-focused blocs that maintain some level of cooperation.

Key Elements:

Northern Alliance: Led by economic powerhouses like Germany and the Netherlands.

Southern Bloc: Focused on Mediterranean nations like Italy, Spain, and Greece.

Eastern Partnership: Strengthened ties between Eastern Europe and non-EU neighbors.

The map shows how EU countries might split into three regional blocs post-collapse:

Northern Bloc (Blue): Wealthy, export-driven economies like Germany, France, and the Nordics.

Southern Bloc (Green): Mediterranean nations like Italy and Spain, focusing on tourism and agriculture.

Eastern Bloc (Red): Transitioning economies like Poland and Hungary, emphasizing security and regional trade

3. New Economic Unions

Countries may form alternative economic partnerships to replace the EU’s single market.

Key Elements:

Trade Networks: New agreements with global powers like the U.S., China, and the UK.

Digital Economy: Partnerships in technology and innovation sectors.

4. Historical Comparisons

Drawing lessons from past unions, such as the USSR or Yugoslavia, could inform decisions for Europe's future.

Key Elements:

Avoiding Pitfalls: Learning from the economic and political errors of previous unions.

Cultural Identity: Balancing unity with national sovereignty.

What If America Leaves NATO? Implications for Global Security and Alliances

Impact on European Security:

NATO has been a cornerstone of European defense since 1949, with the U.S. providing the bulk of its funding and military capabilities.

Without U.S. support, European nations would be pressured to significantly increase their defense budgets, creating economic strain on already debt-burdened nations.

A weakened NATO could embolden adversaries like Russia, raising the likelihood of regional conflicts in Eastern Europe.

Strategic Realignment:

European nations might attempt to form a new defense alliance or expand the EU’s military capabilities, but this would take years to match NATO’s current strength.

Other global powers like China or Russia could exploit the vacuum, reducing Europe’s geopolitical influence.

Economic and Political Fallout:

Defense spending reallocations could slow economic recovery post-EU collapse, adding to financial instability.

Political alliances within Europe might fracture further as member states disagree on how to manage security independently.

Key Insight: America’s exit from NATO would force Europe into a precarious position, accelerating political and economic divides while making regional security far more uncertain.

Conclusion

The European Union stands at a crossroads, facing significant challenges and opportunities. While the possibility of collapse looms, the EU's history of resilience and adaptability suggests it is far from inevitable.

Key Takeaways

The EU's economic integration, valued at over €3 trillion in annual trade, highlights its critical role in global stability. A collapse would disrupt international markets and weaken Europe’s geopolitical influence.

Social and political consequences, such as restricted mobility, rising economic inequalities, and weakened alliances, would reshape Europe as we know it.

However, data also shows that the EU has weathered past crises, including the 2008 financial crisis and Brexit, with strong recovery efforts.

Alternative Futures

The future of the EU may lie in one of several pathways:

Incremental Reforms: Strengthening economic and political policies to address disparities.

Regional Blocs: Nations aligning into smaller cooperative groups.

New Unions: Shaping new economic partnerships to adapt to global changes.

Open Question

Is the EU’s resilience stronger than the forces pulling it apart, or are we witnessing the prelude to a new European order?

What do you think Europe’s future holds? Share your perspective in the comments or join the conversation!

What happens if America gets out of NATO?

BTW how were the European economies doing prior to the EU, say 1946-1990?